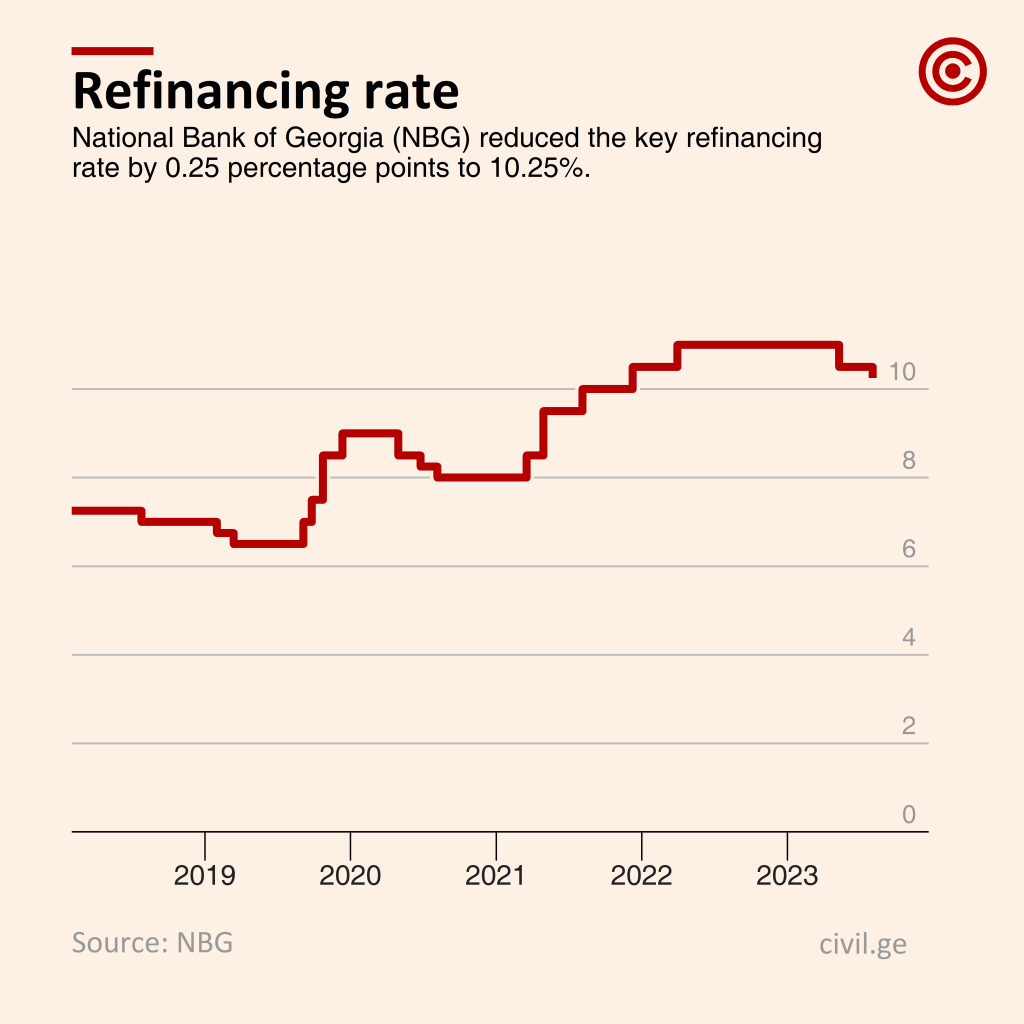

NBG Reduces Key Refinancing Rate from 10.5% to 10.25%

On August 2, the Monetary Policy Committee of the National Bank of Georgia (NBG) reduced the key refinancing rate by 0.25 percentage points to 10.25%.

The NBG cited a downward trajectory of inflation as the reason for the reduction. In June, annual inflation in Georgia was at 0.6%. This was influenced by external factors, including lower prices of food, raw materials, and oil in international markets. The cost of international shipments also decreased, and the stronger exchange rate of the GEL reduced the prices of imported goods in Georgia. Additionally, tighter monetary policy and lower inflationary expectations contributed to the decrease in local inflation, which stood at 8.5% in June, although still declining at a relatively slow pace.

- 03/07/2023 – Georgia’s Annual Inflation at 0.6% in June

The Central Bank said that in the short term the annual inflation rate is expected to decline further below the target and stabilize at around 3% in months after 2023. “After a long period of high inflation, inflation well below the target level will contribute to further normalization of long-term inflationary expectations, which, in turn, is a prerequisite for price stability.”

Despite the positive trends, the NBG clarifies that uncertainty is still high due to the geopolitical situation. Considering the inflation dynamics and forecasts of the previous Monetary Policy Committee meeting, the NBG decided to start a gradual exit from its tight monetary policy stance, which implies refinancing rate reduction at a moderate pace. “The NBG continuously monitors the developments in the economy and financial markets and will use all available instruments to ensure price stability,” – the bank added.

The next meeting of the Monetary Policy Committee will be held on September 13, 2023.

Also Read:

- 21/06/2023 – NBG Keeps Key Rate at 10.5%

- 10/05/2023 – Central Bank Reduces Key Rate from 11% to 10.5%

- 29/03/2023 – Central Bank Holds Key Rate at 11%

This post is also available in: ქართული Русский