NBG Replenishes International Reserves as IMF Praises Georgia’s ‘Resilience’

Georgia’s central bank has been steadily replenishing its international reserves in recent months, as the International Monetary Fund (IMF) praised the ‘resilience’ of the Georgian economy amid both domestic and international challenges. Experts have linked the country’s macroeconomic stability to strong exports, tourism-related growth, and sustained foreign transfers, particularly from the European Union.

National Bank of Georgia (NBG) purchased nearly USD 900 million in the first six months of 2025, filling its international reserves after selling roughly the same amount last year. According to official data, the purchases totaled USD 879.5 million and were made on the Bmatch trading platform. The NBG bought USD 101.7 million in March, USD 266.4 million in April, USD 245.4 million in May, and USD 266 million in June.

The bank said that, as of June, Georgia’s international reserves stand at USD 4.7 billion. The next update is going to be announced for the end of August.

“The NBG is always focused on refilling the reserves, which is confirmed by the bank’s declared policy,” the central bank added, noting that “when the market allows this, the National Bank grows the country’s international reserves.”

The refilling of foreign exchange reserves follows the sale of more than USD 900 million last year. The NBG sold about USD 220 million in May and June amid mass protests over the foreign agents law, and nearly USD 700 million in September and October ahead of the parliamentary elections.

In October 2024 alone, with the elections held on the 26th, the NBG sold USD 591 million to prevent a currency devaluation, causing a dramatic USD 630 million drop in reserves and bringing them down to USD 4.08 billion, marking the largest one-month decline in history. Georgian Dream government critics were concerned about the “depletion” of international reserves.

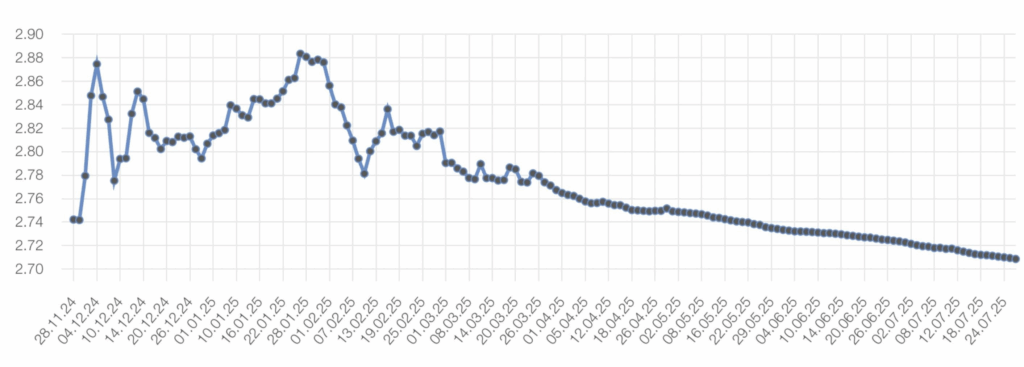

Buying interventions come amid the gradual and steady appreciation of the Georgian lari (GEL) against the U.S. dollar, months after initial crisis-driven volatility.

“Georgia has shown remarkable resilience amid heightened domestic and geopolitical uncertainty, with strong growth, near target inflation, and moderate debt levels,” the International Monetary Fund (IMF) Executive Board said in its July 22 report on Georgia. The report, however, warned that “domestically, heightened political uncertainty and potential sanctions could dampen FDI, tourism, and pressure the lari.”

The IMF also expressed concern over the independence of the National Bank of Georgia, currently led by Georgian Dream loyalist Natia Turnava.

“Strengthening NBG governance and independence remains an important priority. There has been progress on implementing past recommendations, including filling board vacancies and appointing a governor. However, proposed amendments to enhance governance and financial autonomy in the NBG Law remain outstanding,” the report said.

EU-Dominated Inflows

While the economy has remained a top concern for Georgians at the individual level, experts attribute the country’s improved macroeconomic indicators to growing foreign currency inflows.

“Net foreign currency inflows, combining merchandise trade, tourism revenues and instant money transfers, improved further in June,” TBC Capital, a Georgian bank-affiliated think-tank, said in its July 25 newsletter.

The European Union has been the top source of foreign inflows, accounting for 20.3% of all inflows in the second quarter of 2025 — the highest share since the first quarter of 2022. The EU’s contribution is particularly notable in remittances, with an average of 46% of money transfers to Georgia coming from EU countries throughout 2025. The next strongest source of remittances has been the United States, making up 19% of transfers in recent months. Russia’s share, meanwhile, stood at 13% in June — a rebound from its all-time low of 10.5% recorded in January this year.

The Georgian economy, particularly at the level of individual households, is heavily dependent on remittances, which accounted for 11.8% of Georgia’s GDP in 2024.

The improvement in net inflows has also been aided by external trade trends, with strong exports, mainly driven by car re-exports, and muted growth in imports, TBC Capital said.

According to the think-tank, other Lari-supportive trends included strong exports, largely driven by car exports, somewhat subdued imports, a weak USD, and growing tourism-related inflows. International visitor trips increased by 4.6% year-over-year in the first half of the year, reaching 2.81 million. In this period, Georgia generated USD 1,971 million from foreign travel, up by 3.8% year-over-year, with Russia (USD 308 million), the EU and UK (USD 277 million), and Israel (USD 242 million) among the top contributors.

As for migration-related non-cash spending, the think tank estimated that expenditures by Russians, Belarusians, and Ukrainians, many of whom settled in Georgia following Russia’s full-scale invasion of Ukraine, remained flat in June and saw a slight decline in July.

The inflation, on the other hand, amounted to 4% year-on-year in June, largely driven by growing food prices.

Also Read:

- 18/07/2025 – NBG Denies Seeking SWIFT Alternative After Meeting With Chinese Payment System Head

- 18/06/2025 – NBG Keeps Key Refinancing Rate Unchanged at 8%

- 21/12/2024 – Businesses Back Georgian Protests as Crisis Disrupts Economy

- 28/11/2024 – As Reserves Faded, National Bank Seeks to Refill Them from Market