Study: 62% of Businesses Negatively Affected by Russia-Ukraine War

The Business Association of Georgia (BAG) released the results of a new survey, in its BAG Index series assessing the impact of the Russia-Ukraine War on businesses in the second quarter of 2022 which found that 62% of surveyed companies said that the war and/or sanctions imposed on Russia have negatively impacted their businesses.

The survey, which the PMC Research Center carried out, was conducted amongst the 91 companies which make up the BAG. These include almost all larger actors, such as oil distribution companies (SOCAR, Gulf, Lukoil), banks (TBC Bank, Kartu Bank), Georgian Railways, communication companies, pharmacy chains, construction companies, and many others.

Among them, 12% of companies said that the effect on their business had been ‘very negative,’ while 22% said that it had not had an impact and a mere 3% said the impact was positive.

The report reads that the trade sector was the most hit, with 71% of companies saying that they were negatively affected and a further 11% saying the impact was ‘very negative.’

Factors Affecting Trade

Regarding the factor that affected companies most due to the Russia-Ukraine war and resulting sanctions, 72% of companies cited logistical problems in the global market, followed by increased prices on intermediate goods (56%), hindered imports-exports with Ukraine (48%), and aggravation of trade relations with Russia (39%).

Looking at the trade sector, however, the most-stated hindering factor was logistical problems (90%), while the least-cited factor was the worsened trade relations with Russia (41%).

Similarly, in the service sector, the most-stated factor was logistical problems (57%), while the least-cited factor was the aggravation of trade relations with Russia (33%).

Meanwhile, the construction sector cited increased prices on intermediate goods (78%) and logistical problems (78%) the most. In this case, also, the least-cited factor was worsened trade relations with Russia (33%).

Finally, in the manufacturing sector, the most-stated factor was hindered imports-exports with Ukraine (82%), while less often cited factors were increased prices of intermediate goods (55%) and worsening trade relations with Russia (55%).

Aggravated Trade Relations with Russia

When taking an in-depth look at the companies who cited aggravated trade relations with Russia to be hindering their business activity, payment issues were most often stated as the underlying reason (68%), followed by hindered logistics, including freight insurance issues (58%), and export barriers imposed by Russia (39%).

Notably, the least stated factors were reputational problems (26%) and trade partners being listed as sanctioned companies (19%).

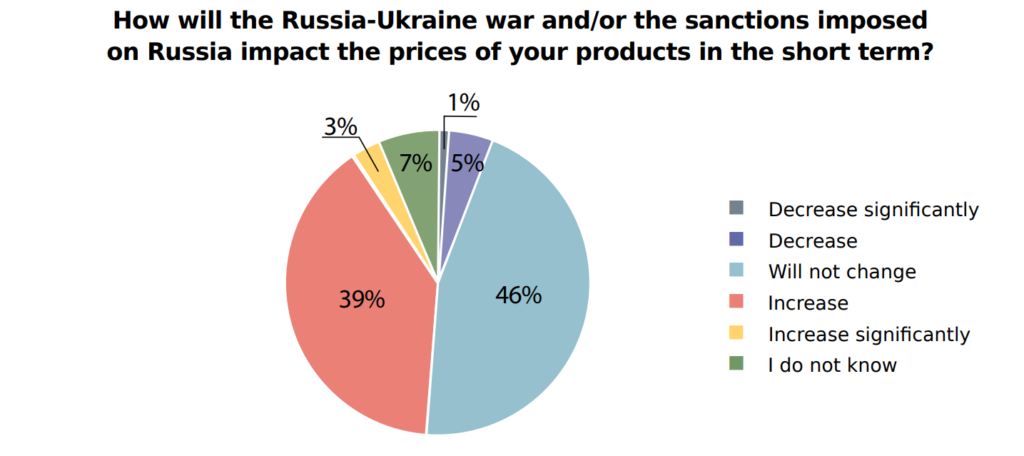

Impact of War on Product/Service Prices

Asked about whether the Russian invasion of Ukraine and resulting sanctions will impact product prices in the short term, 46% of surveyed companies did not expect it to have an impact while 39% did expect an increase in prices, and a further 3% expect significant increases.

Significantly, the trade sector had the highest expectations for price increases (52% expect prices to increase), followed by the construction sector (45%), while such expectations were the lowest in the service sector (35%).

Impact of War on Number of Employees

The majority of companies surveyed (85%) said that they do not expect the war in Ukraine and resulting sanctions on Russia to have an impact on the number of employees in their company. In fact, only 8% of businesses expect their number of employees to decrease and a mere 1% expect it to decrease significantly.

By sector, a decline in the number of employees was most expected in manufacturing, with 28% of companies expecting the number of employees to decrease in the short run, and was least expected in the trade sector (3%).

Among those expecting a decline in employees, the majority (67%) expect the decline to be between 1-20%, while 25% of them expect it to decline by 21-40%, and 11% expect a 41-60% decline. Notably, none of the companies expected a decline of more than 60%.

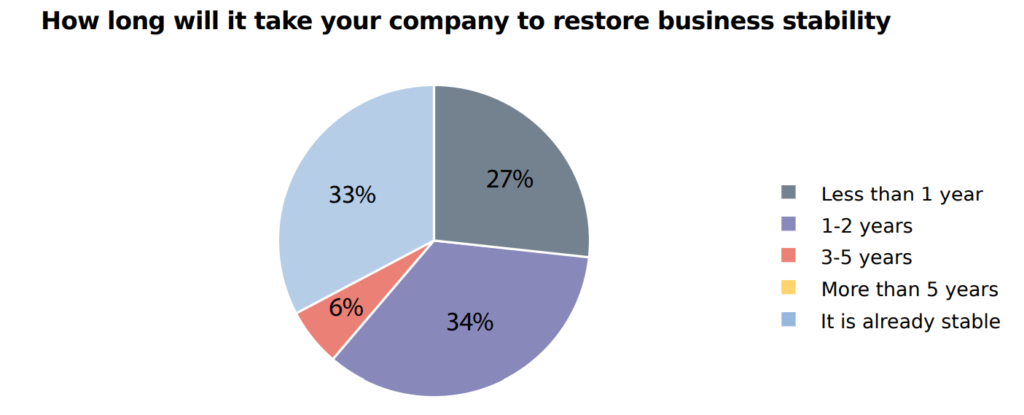

Recovering to a Pre-War Situation

Among the companies to have been affected negatively by the war, 34% stated that recovering to a pre-war standing will take them 1-2 years, while 27% said it would take them less than one year and only 6% said it would take them 3-5 years to recover.

It should be noted that none of the companies stated that it would take them more than five years to recover and that 33% said they were already in a stable position.

Across sectors, the level of stability was highest in trade (48%), while the lowest was in the manufacturing sector, where only 11% of companies said that their businesses were already stable.

Read the full survey here.

This post is also available in: ქართული Русский