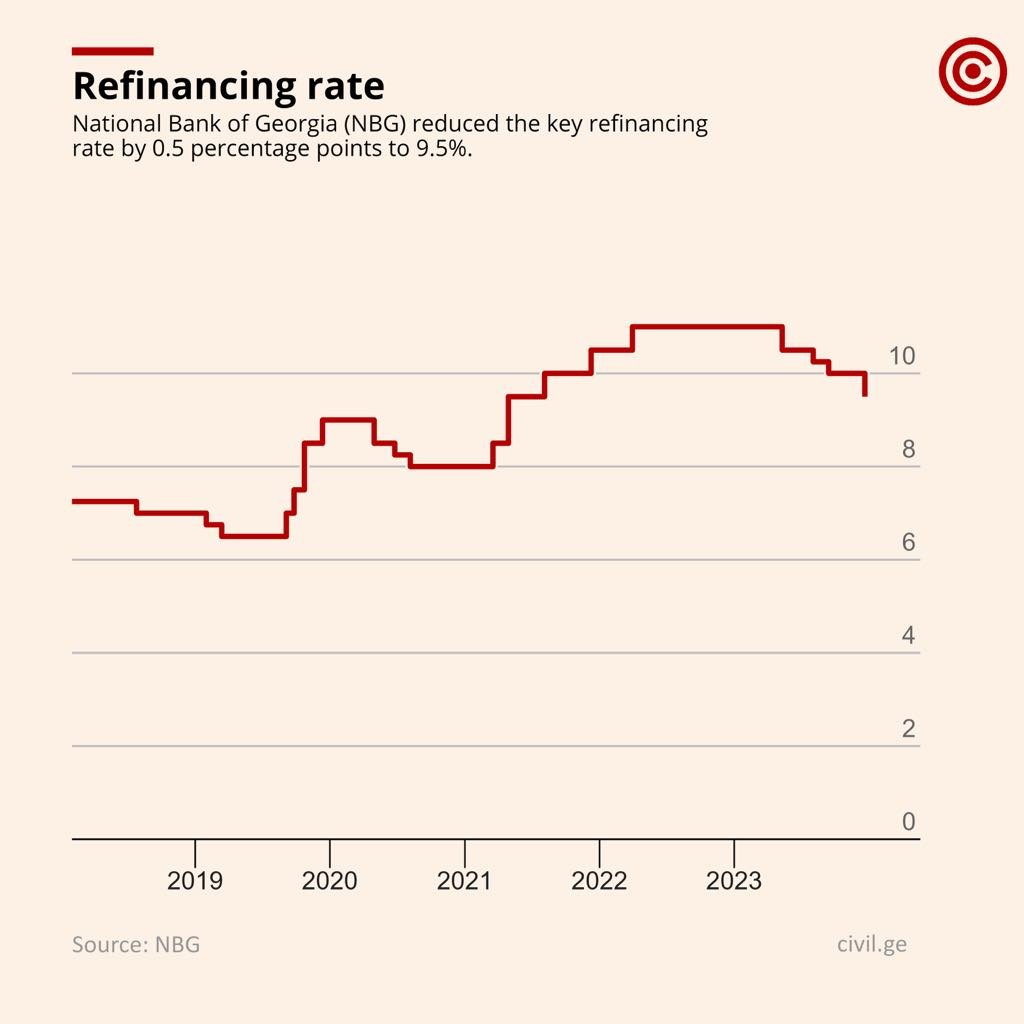

NBG Reduces Key Refinancing Rate from 10% to 9.5%

On December 20, the Monetary Policy Committee of the National Bank of Georgia (NBG) reduced the key financing rate by 0.5 percentage points to 9.5%. According to the NBG, inflation in Georgia continued to decrease more than anticipated, standing at 0.1% in November.

NBG noted that core inflation reached 1.8% in November, also following a downward trajectory. This tendency was driven by external as well as internal factors. According to the NBG, its tight monetary policy “effectively anchored” inflation expectations that continued to decline in November. Moreover, inflation of domestically produced goods has gradually approached the 3% target, standing at 3.8% in November. The NBG also added that the stability in international commodity prices still contributes to maintaining low inflation for imported goods.

However, despite with the positive trends, the NBG also speaks of “notable inflationary risks.” According to the same information, in particular, economic growth dynamics pose the risk of demand-side inflationary pressures. “Preliminary data suggests robust domestic demand, with the average annual economic growth from January to October recorded at 6.9 percent.” “The NBG is vigilantly monitoring the economic dynamics and stands prepared to implement necessary measures should signs of sustained inflationary pressures emerge.”

Citing inflationary risk assessments, the NBG notes that despite the current reduction, the monetary policy rate continues to be maintained at a relatively elevated level. “The NBG will continue only a gradual normalization of monetary policy, in alignment with the evolving inflation forecasts.”

The next meeting of the Monetary Policy Committee is scheduled to be held on January 31, 2024.

Also Read:

- 25/10/2023 – NBG Keeps Key Refinancing Rate Unchanged at 10%

- 13/09/2023 – NBG Reduces Key Refinancing Rate from 10.25% to 10%

- 02/08/2023 – NBG Reduces Key Refinancing Rate from 10.5% to 10.25%

- 21/06/2023 – NBG Keeps Key Rate at 10.5%

This post is also available in: ქართული Русский