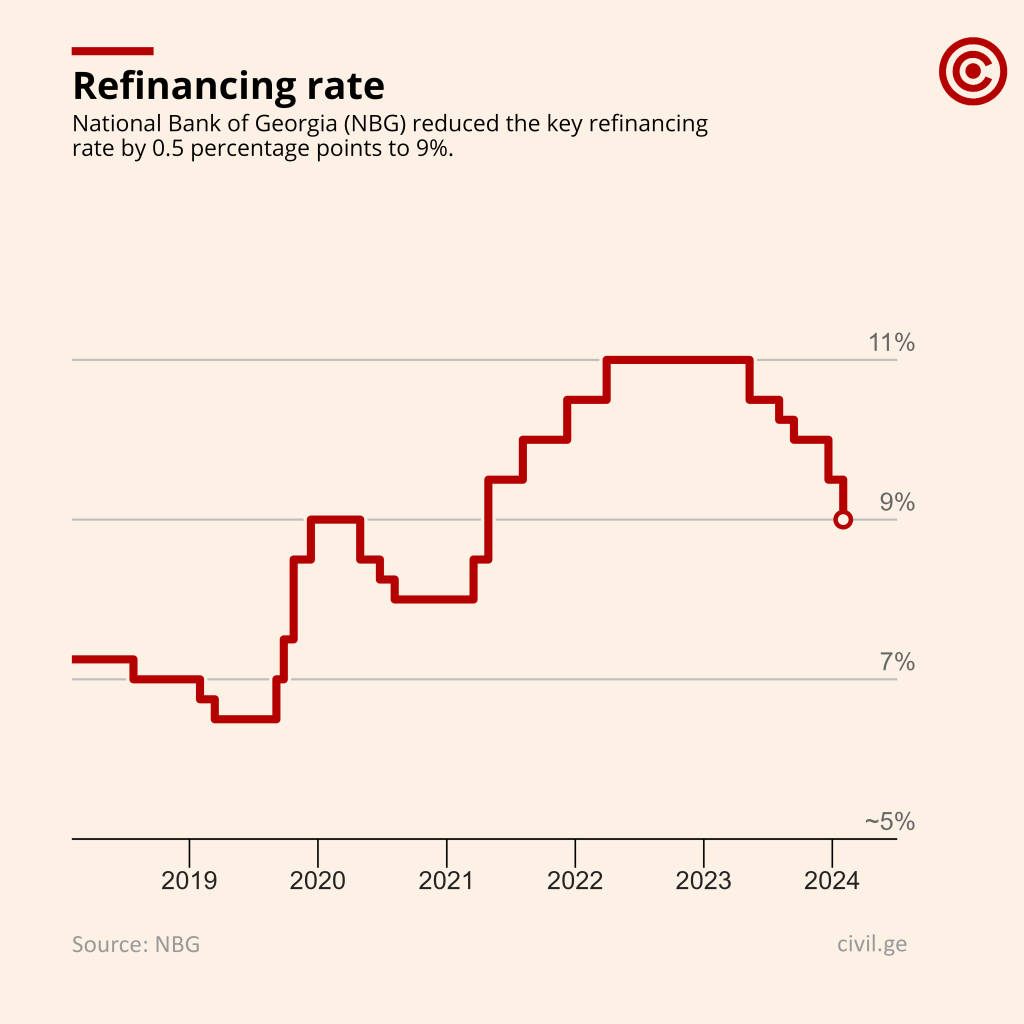

NBG Reduces Key Refinancing Rate from 9.5% to 9%

On January 31, the Monetary Policy Committee of the National Bank of Georgia (NBG) reduced the key refinancing rate by 0.5 percentage points to 9%.

Inflation remains low in Georgia. In December, headline inflation increased by 0.4 percent annually, while core inflation was 1.9 percent. According to the NBG, Georgia’s low inflation is the result of tight monetary policy and lower inflation expectations, as well as a significant decline in external shocks, such as those caused by the war and the pandemic. The central bank also lowered its inflation forecast, citing lower-than-expected inflation coupled with lower electricity prices, and said inflation is expected to remain below the 3 percent target in early 2024.

Despite the positive trends, the NBG says that inflation risks are also noteworthy. It points to the geopolitical environment, which contributes significantly to uncertainty about transportation costs. In addition, the NBG highlights the domestic economy in terms of its impact on inflation. It highlights the robust economic activity last year, saying that the real GDP growth rate was 7.0 percent in 2023. The NBG notes that Georgia’s real GDP has fully recovered to its pre-pandemic trend. It adds that economic activity is expected to gradually normalize in 2024 in line with the growth rate of potential GDP, which is estimated at 5 percent.

In view of the above factors and risks, the NBG decided to maintain its tight monetary policy stance and lowered the key interest rate by 0.5 percentage points to 9 percent. The NBG also highlights the impact of the granting of candidate status to Georgia, stating that it has “visibly reduced the sovereign risk premium, which, other things being equal, could lead to a lower neutral policy rate”. However, the NBG notes that despite the recent rate cut, its monetary policy will remain tight and will only continue a gradual normalization of monetary policy. “If factors amplifying inflation expectations become apparent, the NBG will maintain a tight monetary policy stance for a longer period or further tighten its policy,” – the NGB notes.

The next meeting of the Monetary Policy Committee will be held on March 13.

Also Read:

- 20/12/2023 – NBG Reduces Key Refinancing Rate from 10% to 9.5%

- 25/10/2023 – NBG Keeps Key Refinancing Rate Unchanged at 10%

- 13/09/2023 – NBG Reduces Key Refinancing Rate from 10.25% to 10%

- 02/08/2023 – NBG Reduces Key Refinancing Rate from 10.5% to 10.25%

This post is also available in: ქართული Русский