Report: Russian Capital in Georgian Business

The Institute for the Development of Freedom of Information (IDFI), a watchdog, recently released a report as part of the third phase of its study, titled “Russian Capital and Russian Connections in Georgian Business.” IDFI analyzed the construction sector, investments in tourism/hotel services, and road transport. As part of their investigation, IDFI explored the impact on these sectors resulting from two waves of Russian citizens entering Georgia in 2022.

In their analysis of Russian capital and connections, the researchers examined information on company owners and shareholders, connections with Russian government circles, involvement in politics and business, direct investments and sources of funding from Russia. They also looked at areas of business activity and other interests, projects undertaken, funding of political parties/actors, organizations, media, events, and activities. The researchers looked at partner organizations in Georgia and possible links with Georgian political groups/parties/politicians/state officials/activists/journalists, as well as public perception of their activities and lobbying tendencies.

Key findings

According to the report, there was a significant increase in the share of Russian citizens involved in house/apartment purchase transactions in Tbilisi and Batumi. From January to November 2022, the share of Russian citizens in Tbilisi transactions rose from 0.9% to 5%, while in Batumi, it increased from 5% to 17.6%. The study, based on data released by the National Public Registry Agency, revealed that Russian citizens purchased a total of 15,164 buildings/structures (including 13,262 apartments) and 13,850 plots of land in Georgia by September 9, 2022.

The report also highlighted that as of December 31, 2022, there were 161,032 Russian citizens (individuals) and 55 legal entities holding accounts in Georgian commercial banks. Furthermore, the deposits made by Russian citizens in the commercial banks of Georgia reached 2.87 billion GEL by December 2022, which is an increase of 2.16 billion GEL compared to the pre-war rate in January 2022.

The report mentions data provided by the National Tourism Administration, which indicates that in 2022, the number of visitors from Russia reached 1,087,257, representing a quarter of the total international visitors. Additionally, the National Bank’s data reveals that the income generated from trips made by Russian citizens to Georgia amounted to 891 million US dollars, also constituting a quarter of the total income from international visits. The report also highlights that in 2022, there were 1.46 million instances of Russian citizens crossing the Georgian border, and as of the ninth month of that year, 112,733 Russian citizens remained in the country.

Furthermore, the report reveals a significant increase in the number of products entering Georgia’s border from Russia via freight transport. The figures indicate a notable rise from 22,606 tons in 2021 to 36,797 tons in 2022. It is noteworthy that the import of cereal products has doubled, accounting for the largest share among imported products in 2022, with 8,184 tons. Additionally, the import of fats and oils has nearly doubled, reaching 3,891.5 tons.

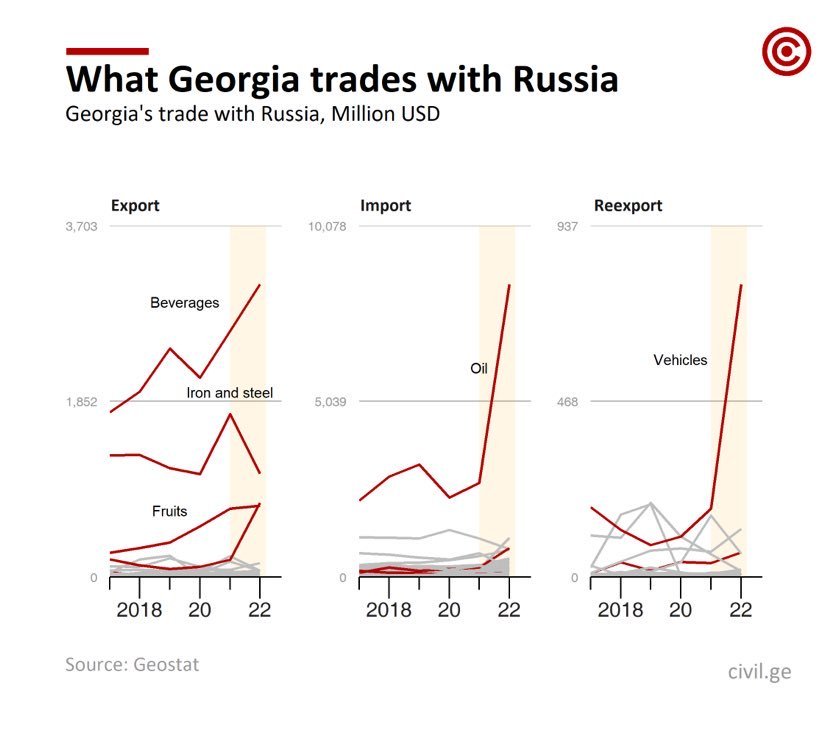

The report also highlights a considerable growth in the export of goods to Russia, with a 38% increase in January-February 2023. Likewise, exports to Armenia experienced a significant surge of 197%. Trade experts suggest that the trade patterns demonstrate a substantial portion of the increased exports in Central Asia and the Caucasus being directed towards Russia, emphasizing the significance of re-exports from Georgia to Russia within this context.

The report highlights a significant surge in the share of Russian products in the oil sector. In comparison to 2021, the overall value of oil imports from Russia has skyrocketed by 361%. Among the five major players in the market, four of them, namely “San Petroleum Georgia” (Gulf), “Lukoil Georgia”, “Wissol”, and “Socar”, receive their fuel from Russia. Additionally, the import of natural gas from Russia to Georgia witnessed a 24% increase, with the cost rising from $90.7 million in 2021 to $112 million in 2022. Notably, Russian imports account for 25% (252.2 million kWh) of the total imported electricity, while Azerbaijan contributes 60% and Turkey contributes 15%.

Russian influence/connections

In the report, Russian influences and connections within Georgian businesses have been explored by IDFI. The organization highlights the ownership of Georgia’s “Borjomi” mineral water production by Russian oligarch Mikhail Fridman’s “Alfa-Group” corporation. The report also brings attention to Russian connections, ownership and management shares, as well as affiliations with ruling parties, in other mining and mineral water sectors. Notable mentions include RMG Gold, Capital Group LLC, Mega Holding LLC, Gruzvinprom, and “Mixor” LLC. Sairme Mineral Waters LTD was specifically highlighted in the report, since it possesses five licenses for extracting mineral waters. The company’s owner and a member of the supervisory board are both Russian citizens. The board member, Gia Gvichia, is a well-known billionaire in Russia, while his sister, Nana Gvichia, holds the position of chairman of the Tourism Development Committee of St. Petersburg.

Additionally, the report underlines the significant influence of the former member of the “Alliance of Patriots of Georgia”, Pridon Injia and his family, in the field of communications. Known for its proposals to get closer to Russia, Injia controls 25.19% of the telephone market and 6.2% of the Internet market through new networks and CGC. Additionally, he possesses Foptnet LLC, a company that has a business partnership with the Russian firm “Westelecom,” which is, in turn, a subsidiary of the Russian communication company “Rostelecom.”

Conclusion

The report concludes that the unregulated emigration policy during the Russia-Ukraine war has led to a significant rise in the number of Russian citizens crossing the Georgian border and staying in the country, resulting in an increased demand and rising prices in the real estate market, despite the limited involvement of Russian citizen developers in Georgia’s construction sector. Notably, out of 20 registered medium-sized foreign companies and/or their branches, only three are founded by Russian citizens, and none of the large-scale economic operators are related to Russia.

IDFI has uncovered systematic indications of influence and the presence of Russian capital in sectors that hold significance for Russia’s current priorities, particularly in efforts to find alternative markets in place of Europe. Sectors such as oil, natural gas, and electricity demonstrate notable Russian influence. Additionally, Russian involvement appears excessive in strategically important sectors, including minerals and communications. The management of companies in these sectors intersects with both Russian entities and the ruling party, indicating a potential alignment of the ruling party’s policies with Russian interests in crucial Georgian assets.

Furthermore, the significant upward trajectory of import and export activities serves as another indication of the deepening economic ties between Russia and Georgia. It is worth noting that currently only the Georgian companies are engaged in truck road transport within Georgia, despite the growing demand and load. None of the 15 registered medium-sized companies in this sector are of Russian origin.

The report says that despite the increasing influx of visitors from Russia, the field of hotel services in Georgia still lacks Russian or related companies, based on 2022 data. Similarly, in the banking sector, it is noteworthy that only VTB Bank Georgia, owned by the Russian company VTB Bank Russia, can be identified. Nevertheless, the report stressed that following the onset of the war in Ukraine, the National Bank of Georgia joined international sanctions, leading VTB to sell its portfolios to other banks.

Despite the relatively limited presence of Russian interests in the mentioned sectors of construction, tourism, logistics, and banking, the growing interest and consumption by Russian citizens can be considered an important factor that may attract Russian companies to these sectors in the future.

Also Read:

- 08/06/2023 – Report: Rate of Responses to Freedom-of-Information Requests Hits a 13-year Low

- 14/03/2023 – IDFI’S 2022 Report on Access to Public Information in Georgia

- 24/01/2023 – IDFI Reports on Employment of Family Members of Judges in Public Sector

- 16/01/2023 – IDFI Reports on Shortcomings in Proactive Disclosure of Public Information

This post is also available in: ქართული Русский